Do you want to save money this year? Of course, you do! Who doesn’t want to save money? The good news is that it’s easier than you think. We’ve created a free savings challenge printable that will help you save thousands of dollars this year. We’ll walk you through ten different ways to start saving money today.

Save Money by Automating Your Finances

If you are like most people, it can be hard to keep track of all your money. You might have a lot of bills, credit card payments, and savings goals. This can seem very overwhelming. But there is a way to make it easier! If you automate your finances, you do not have to worry about it as much. This way, you have more time for things that you enjoy doing.

One way to automate your finances is to set up a budget. This may sound tedious, but there are a lot of helpful budgeting tools available online. Once you’ve set up your budget, you can automate your bills and investments so that you don’t have to think about it every month. And if you stick to your budget, you’ll be surprised how much easier it is to save money!

Saving Money by Cutting Back on Unnecessary Expenses

Saving money can feel like a never-ending battle. Every time you turn around, there’s another expense waiting to eat up your hard-earned cash. However, by making small changes in your spending habits, you can free up some extra cash to put toward your savings goals. One way to do this is to cut back on unnecessary expenses, such as cable TV or eating out. If you’re not careful, these small luxuries can quickly add up.

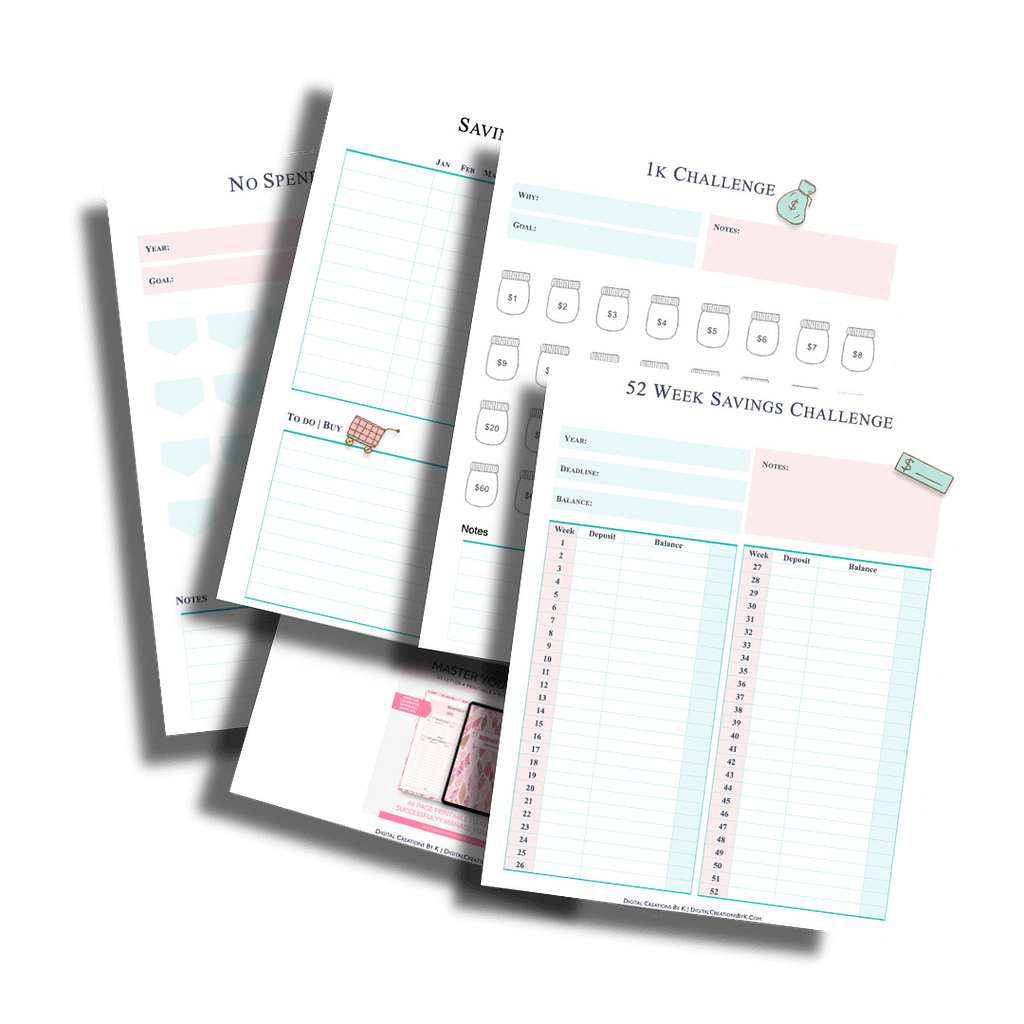

However, by eliminating them from your budget, you can free up some extra cash to put toward your savings goals. And, if you’re looking for an extra challenge, why not try the FREE Savings Challenge Printable? This handy tool will help you track your progress and stay on track with your savings goals.

Side Money

There are plenty of ways to make a little extra money on the side, and it can be well worth the effort. From freelancing to pet sitting, to selling on Etsy, there are many options available. One great way to boost your income is to start a FREE savings challenge. This can be a great way to put away some extra cash each month, and it can add up over time.

Improve Your Skill Set by Investing in Yourself

Taking free online courses is a great way to invest in yourself and improve your skill set. Improving your skill set can lead to a better job and a higher salary. And, as a bonus, it can also help you save money!

By taking courses on topics like personal finance or investing, you can learn how to better manage your money. This knowledge can help you save money in the long run and make smarter decisions with your finances.

Sell on eBay or Amazon

Spring is here and that means it’s time for a fresh start! One easy way to declutter your home and earn some extra cash is to sell on eBay or Amazon. You can list items for free on both platforms, and you decide how much to charge for shipping.

If you’re not sure what to sell, start with items that are in good condition and have a high resale value, like designer clothes or electronics. You can also look for items that are unique or hard to find, as these will be more likely to sell for a higher price. So why not give it a try? You might be surprised at how much fun it is – and how much money you can earn!

Use a Rewards Credit Card to Earn Cash Back on Everyday Purchases

Rewards credit cards are a great way to earn cash back on everyday purchases. With a rewards card, you can earn up to 5% cash back on eligible purchases, which can add up quickly. Plus, many rewards cards offer sign-up bonuses, such as a FREE $200 cash back after you spend $500 in the first 3 months.

And there’s no need to worry about rotating categories or keeping track of points – with a rewards card, you simply earn cash back on everything you purchase. So if you’re looking for an easy way to reach your savings goal, consider using a rewards credit card.

Shop Around for Better Rates on Car Insurance, Utilities, and Other Monthly Bills

One of the best ways to save money is to shop around for better rates on car insurance, utilities, and other monthly bills. There are a few ways to do this:

-Call your current provider and ask for a lower rate. Sometimes they will offer a discount if you threaten to switch providers.

-Look online for quotes from other providers. When you find a better rate, switch providers.

-Bundle your services with one company. For example, you can get a discount on your car insurance if you also have homeowners insurance with the same company.

-Take advantage of special promotions. For example, many car insurance companies offer a discount if you sign up for autopay.

So why not give it a try? You could be pleasantly surprised by how much money you can save.

Cancel Any Unused Subscriptions or Memberships

Have you ever looked at your bank statement and wondered where all of your money went? If you’re like most people, a large chunk of your hard earned cash is likely going towards subscriptions and memberships that you no longer use. But there’s no need to waste your money on things that you don’t need. By canceling any unused subscriptions or memberships, you can free up some extra cash each month.

To further boost your savings, take advantage of FREE Savings Challenge Printable. This easy-to-use tool will help you track your progress as you work towards saving $1,000 over 12 months.

Take Advantage of Free or Discounted Activities in Your Area

Looking to save money and have some fun? Why not take advantage of the free or discounted activities in your area? There are often activities for all ages that can help you save money and have a good time. For example, many museums offer free or discounted days, so you can enjoy a day exploring without spending a lot of money.

Local parks often host free events, like concerts and festivals, which are great for spending time with family or friends. And many cities offer discounts on certain days for attractions like zoos and aquariums. So next time you’re looking for something to do, be sure to check for free or discounted activities in your area!

Consolidate your Debt and Reduce Your Monthly Payments

If you’re struggling to make ends meet each month, it may be time to consolidate your debt. By consolidating your debts into one monthly payment, you can save money on interest and reduce your overall monthly payments.

There are several ways to consolidate your debt, such as taking out a personal loan or transferring your balances to a low-interest credit card. You can also work with a nonprofit credit counseling agency to develop a debt consolidation plan that fits your budget.

Money Saving Challenges

Now that we’ve covered 10 ways to save money with Free Savings Challenge Printable, here are some other challenges that can also help you reach your financial goals.

- The 52 week money challenge is a popular choice because it’s simple and easy to follow. With this challenge, you save a little bit more each week, for a total of $1,378 at the end of the year.

- 30-day no-spend challenge – If you’re looking for a short-term challenge with a big impact, the 30-day no-spend challenge may be for you. For one month, you commit to not spending any money, except for essential items like groceries and gas. This can be a difficult challenge, but it’s a great way to save money and reassess your spending habits.

- Cash Envelop System – One popular way to save money is by using the cash envelope system. This involves separating your money into different envelopes for different purposes, such as groceries, bills, and entertainment. When the money in an envelope is gone, you can’t spend any more money in that category. This can be a great way to stay on budget and avoid overspending.

- $5000 Savings Challenge – The “$5000 Savings Challenge” is a more aggressive way to save money. With this challenge, you set a goal of saving $5000 over 12 months. This can be done by setting aside a fixed amount of money each month, or by stockpiling your extra income. Either way, the goal is to have $5000 saved by the end of the year.

Final Thoughts

There are many ways to save money, and we’ve just scratched the surface. By using a rewards credit card, shopping around for better rates, canceling unused subscriptions, taking advantage of free activities, consolidating your debt, and utilizing our FREE Savings Challenge Printable, you can easily save thousands of dollars this year.

With this free printable, you will also receive the 52 week money challenge that will challenge you to put away money each week for a year.

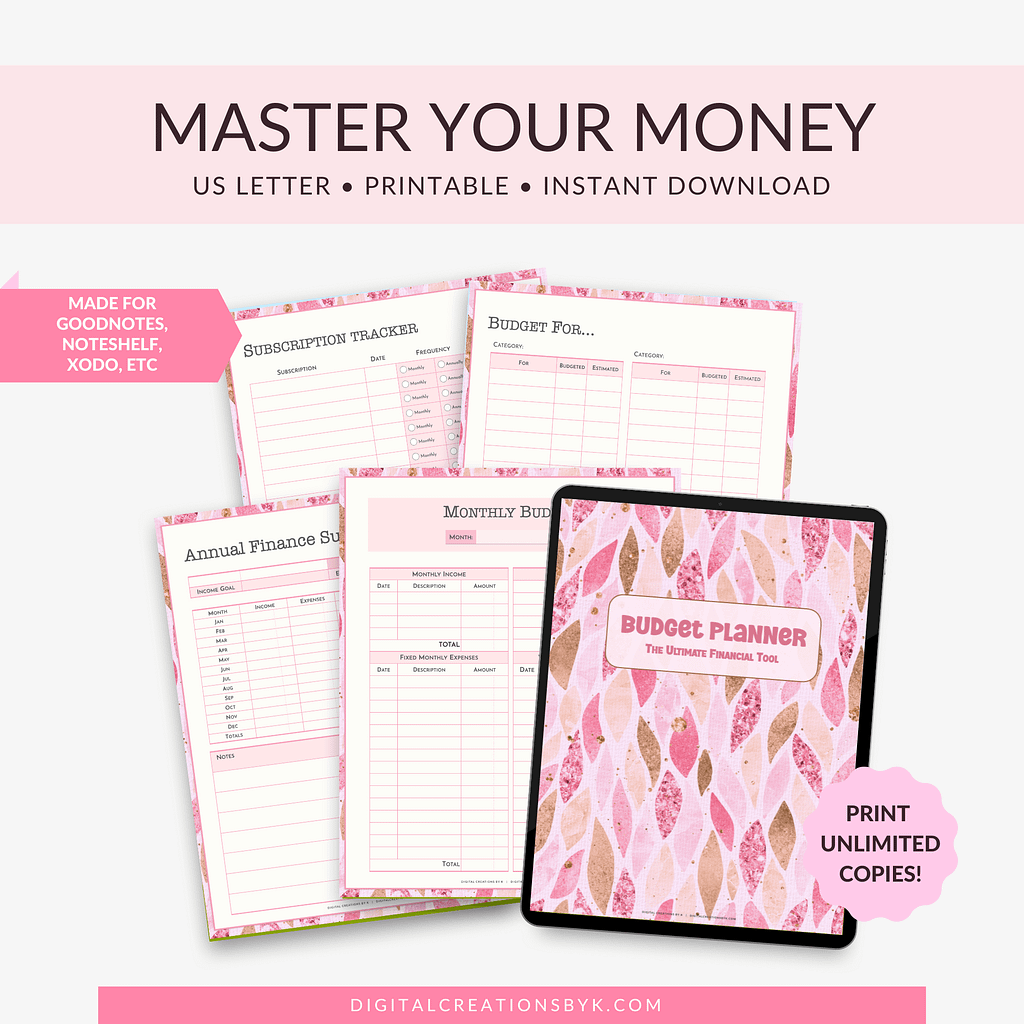

And if you like this free FREE Savings Challenge Printable, I have other amazing money-saving printables as well that might help you with your money-saving goals. This printable was taken from my Master Your Money Budget Planner and if you want to get serious about your financial goals, and track your progress, this planner is going to change your life! Learn more about the Master Your Money Budget Planner.

The post 10 Ways to Save Thousands of Dollars This Year With Our FREE Savings Challenge Printable appeared first on .